The price of gold is currently skyrocketing. Due to rising prices during festivals, common people are moving away from purchasing it. People buy more gold around Dhanteras and Diwali, as it is considered auspicious. Gold can be purchased in a variety of forms, including jewellery, bullion, bars and coins.

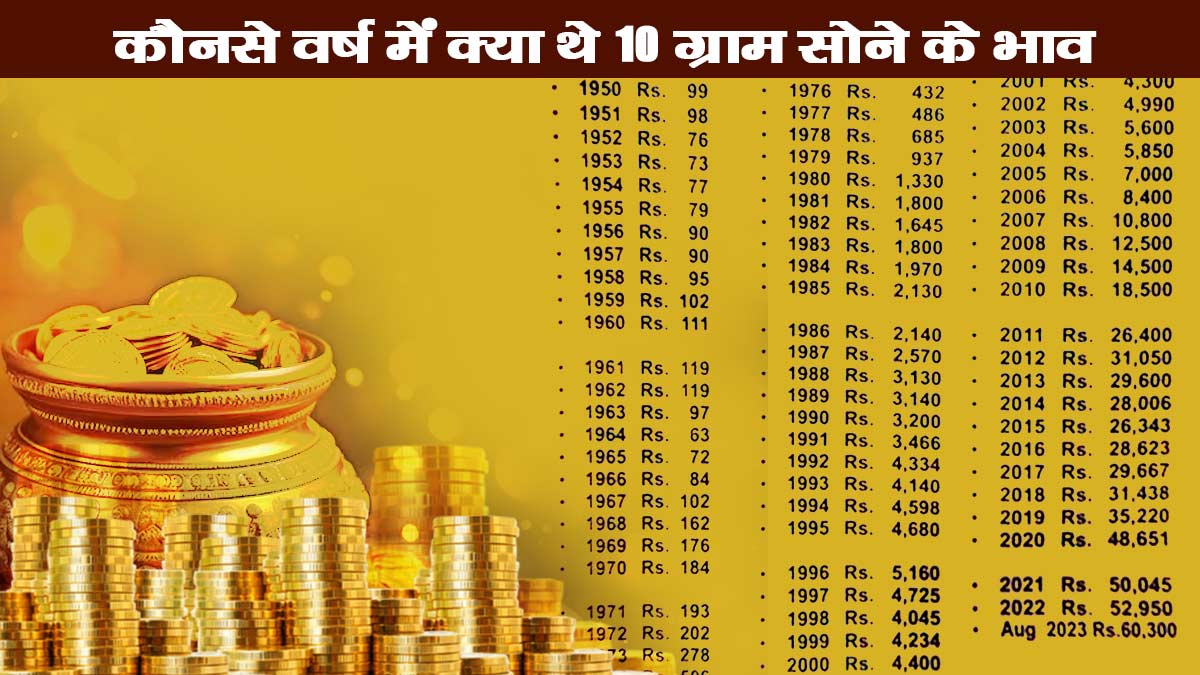

Gold has given more than 40 percent returns this year. According to India Bullion and Jewelers Association (IBJA), on October 16, the price of 10 grams 24 carat gold increased by Rs 757 to reach an all-time high of Rs 1,27,471. Big banks around the world want to reduce their dependence on the dollar, so they are continuously increasing the share of gold in their coffers. The price of 10 grams of gold in India increased from Rs 937 in 1979 to Rs 1330 in 1980, which means the jump in prices was almost 45 percent.

There was an increase of Rs 11 thousand in 2023

According to India Bullion and Jewelers Association (IBJA) had reached its all-time high on September 23. According to IBJA, the price of gold had increased by Rs 11,115 in 2023. On January 1, 2023, gold was at Rs 63,352, which reached Rs 74,467 per 10 grams in September 2023. At the beginning of 2023, gold was at Rs 54,867 per gram, which reached Rs 63,246 per gram on December 31. That means in the year 2023, its price increased by Rs 8,379 (16%).

Prices have increased rapidly in the last 5 years

Gold prices have increased very rapidly in the last 5 years. There are many reasons for this such as the coronavirus pandemic, Russia-Ukraine war, US tariffs and geopolitical uncertainties. Due to all these reasons, gold prices have increased all over the world including India. Central banks of many countries around the world are increasing gold reserves by reducing dollar reserves. Due to this, the international demand for gold remains constant.

Gold prices increased by about Rs 44000 in 1 year

Last year i.e. in 2024, at that time of Diwali, the price of 24 carat gold in major cities was Rs 77,950 per 10 grams. This year, even before Diwali, its price has crossed Rs 1.23 lakh per 10 grams. That is, in just one year, there has been a huge jump in the prices of gold by about Rs 44,000 per 10 grams.

Are rising prices good or bad for India?

According to a recently released report by Morgan Stanley, Indian households own 34,600 tonnes of gold, which is worth approximately $3.8 trillion. This valuation is about 88.8 percent of India’s GDP. According to experts, rising gold prices also affect the country’s economy and have a direct impact on the currency. According to economic experts, India will have to import gold from abroad to meet the increasing demand. To repay the value of this gold, more currency notes will have to be printed and this will affect the value of the rupee. Due to this, there will be a possibility of increase in inflation.

Will gold become cheaper in the coming years?

Gold has always been a reliable option for Indian investors. Gold gives stable returns in times of stock market fluctuations and global uncertainties. If we look at this year’s returns, gold has once again proved to be a ‘safe haven’. Financial experts believe that further increase in gold prices is possible in the next 6 months. According to experts, the price of gold may increase to around Rs 2 lakh per 10 grams in the next 5 years. Edited by: Sudhir Sharma

from business https://ift.tt/aPeK8My

via IFTTT